FINANCIAL FRAUD: Alameda was front-running trades against customers, amassing illicit crypto gains prior to FTX implosion

11/22/2022 / By Ethan Huff

It has been revealed that the trading firm Alameda Research captured large amounts of cryptocurrency tokens ahead of their listing on the now-defunct FTX exchange, a scheme also known as frontrunning.

Reports indicate that between the start of 2021, around the time of heavily shorted GameStop’s meteoric rise, Alameda had begun acquiring about $60 million worth of crypto tokens across 18 listings tied to the Ethereum blockchain, according to an analysis of public blockchain from Argus, a blockchain analytics firm.

Frontrunning is a common occurrence in the crypto world, as well as in the stock world among market makers, but what has been uncovered about Alameda is “much, much greater” than what Argus co-founder Owen Rapaport has ever seen in all his years of work.

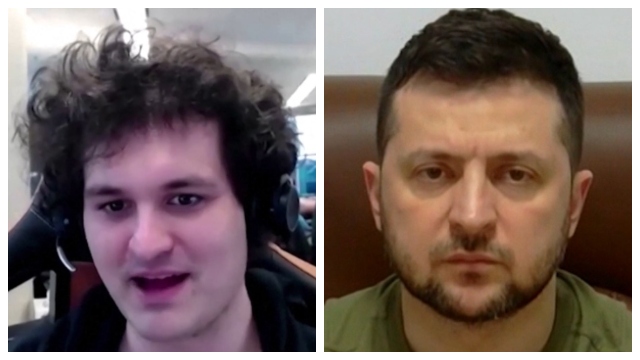

Alameda, by the way, is a crypto trading firm founded by Sam Bankman-Fried, who also owned the FTX crypto exchange. The guy belongs in jail based on what has occurred in the past several weeks, but as of this writing he is still a free man. (Related: FTX was also involved in funneling investor cash to deep state “research” aimed at discrediting ivermectin as a remedy for the Wuhan coronavirus [Covid-19].)

Among the 18 assets that Alameda appears to have been frontrunning since the beginning of 2021 include IndiGG, Guild of Guardians, Render Token, Boba Token, Gala, Gods Unchained, Spell Token, BitDAO, Eden Network, Sandbox, LooksRare Token, RAMP DEFI, Orbs, DOD bird, Convergence, SAND, Linear Token, BaoToken, and Immutable X.

Alameda and FTX were sharing insider information, despite Bankman-Fried claiming they were two completely separate entities

To figure all this out, Rapaport’s team compared Alameda’s on-chain trading of ERC-20 tokens on the Ethereum network to FTX listing announcements that were made between February 2021 and March 2022.

All that time, Bankman-Fried claims that Alameda and FTX remained as two completely separate entities. However, the bank run that ultimately forced FTX’s hand in suspending all withdrawals last week, which then resulted in the company filing for bankruptcy, tell a much different story.

It turns out that a sizeable portion of Alameda’s balance sheet was comprised of FTT, one of the tokens on the FTX exchange. We also now know, thanks to Argus, that Alameda and FTX were sharing information with each other in order to front-run token listings.

Argus, by the way, provides anti-insider trading and employee compliance software services. Simply put, Argus exists to fight against the kind of fraud that Bankman-Fried was overseeing with his two corrupt businesses, Alameda and FTX.

Keep in mind that Bankman-Fried told The Wall Street Journal (WSJ) back in February of this year that Alameda did not have access to insider information about FTX’s token listing plans. It turns out that he was lying.

“Compared to the cases that we’ve seen so far, filed by the federal government, definitely the scale at which Alameda has been front running FTX listings over multiple months, is much, much greater, which reflects that they’re a larger player in the ecosystem and just had a lot more capital to deploy in order to make money here,” Rapaport is quoted as saying.

The hope is that law enforcement will take action against Bankman-Fried and others at Alameda and FTX who appear to have committed the crime of insider trading, among potentially other crimes.

Precedent for this was already established earlier this year when the Department of Justice (DoJ) brought charges against former OpenSea product manager Nate Chastain and former Coinbase product manager Ishan Wahi for trading non-fungible tokens (NFTs) and other tokens using insider knowledge.

The latest news about the FTX scandal can be found at Collapse.news.

Sources for this article include:

Submit a correction >>

Tagged Under:

Alameda, bubble, computing, conspiracy, corruption, crypto, cryptocurrency, deception, deep state, finance, fraud, frontrunning, FTX, market crash, money supply, risk, Sam Bankman-Fried, scam, trading

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 CONSPIRACY NEWS