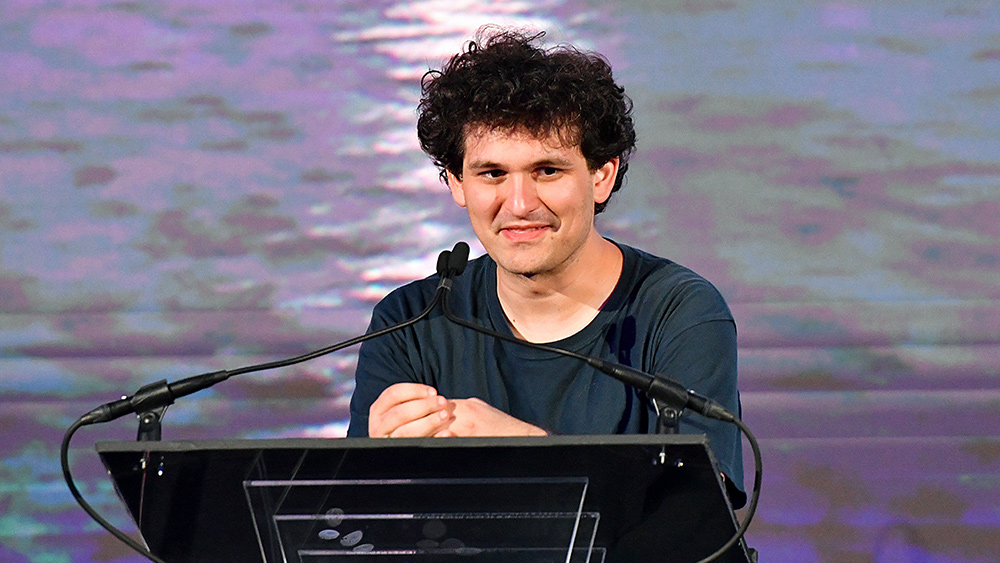

SAM THE SIPHON: Filings show former CEO Sam Bankman-Fried took $2.2 billion in customer funds for personal use

03/21/2023 / By Cassie B.

FTX Co-founder and former CEO Sam Bankman-Fried and five members of his inner circle reportedly pocketed more than $3.2 billion from parts of their crypto empire, including the hedge fund Alameda Research.

Bankman-Fried and the other employees transferred the funds to their personal accounts using the label of “payments and loans.” This is according to filings in bankruptcy court by the company’s new management. The transfers took place prior to the collapse of the crypto exchange late last year, and most of the funds came from Alameda Research.

According to the filings, Bankman-Fried took $2.2 billion for himself, while FTX Co-founder Gary Wang took $246 million, former Alameda CEO Caroline Ellison walked away with $6 million, and former engineer Nishad Singh took $587 million. Meanwhile, Alameda’s former Co-Head Sam Trabucco took $25 million and FTX Digital Markets former Co-CEO Ryan Salame took $87 million.

On top of that, Bankman-Fried and other employees blew more than $240 million on luxury properties in the Bahamas, as well as a series of political and charitable donations. He was arrested in the Bahamas in December.

The 31-year-old former CEO is currently facing a dozen federal criminal charges, including wire fraud, money laundering and unlawful political contributions, that could lead to a sentence of life in prison. He is currently residing at his parents’ California home under house arrest.

FTX is currently being led by John J. Ray III, who was appointed the CEO of the company after it filed for Chapter 11 bankruptcy in November. He has been attempting to recover assets such as cryptocurrency in the hopes of eventually returning it to the millions of customers who have had their accounts frozen in the aftermath of FTX’s collapse.

Bail conditions under review due to judge’s concerns about Bankman-Fried’s tech use

Meanwhile, Bankman-Fried’s lawyer, Christian Everdell, has announced that the disgraced CEO and federal prosecutors are working on a specific set of bail conditions to address concerns that were recently expressed by Judge Lewis A. Kaplan of the Southern District of New York.

The judge identified Bankman-Fried’s use of virtual private network services and encrypted messaging apps while he is out on bail as particularly troublesome. He used the end-to-end encrypted messaging service Signal to contact his former colleagues and the general counsel of FTX, something that Kaplan has forbidden and threatened to revoke his bail privileges if he continues to do. Concerns have been raised that these communications could be an indication of witness tampering.

Kaplan said in court on Friday that he is not convinced Bankman-Fried won’t find a way to get around the tighter bail conditions filed last week, saying: “If he’s determined and inventive, and I suspect he’s very inventive and technologically savvy, he could find a way around it and conceivably not get caught.”

Kaplan is also concerned that he could be using other individual’s devices that are brought into the Palo Alto home where he is staying on house arrest. Prosecutors are requesting that he be permitted to use a device that is not a smartphone, such as a flip phone, while on bail.

Should it prove impossible to monitor his communications to ensure the trial’s integrity, the possibility of jailing Bankman-Fried until his trial has been raised. So far, he has managed to avoid jail time by paying a $250 million bail bond. Prosecutors have been advancing through the discovery process in the case, and his trial is currently set for October.

Sources for this article include:

Submit a correction >>

Tagged Under:

bitcoin crash, bubble, computing, conspiracy, corruption, criminals, crypto crash, deception, fraud, FTX, Glitch, greed, information technology, insanity, money sipply, money supply, rigged, risk, Sam Bankman-Fried, technocrat, theft

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 CONSPIRACY NEWS