Report: Democrats dominate 2023 Congressional stock returns, earning huge gains from insider trading that would land anybody else in prison

01/07/2024 / By Belle Carter

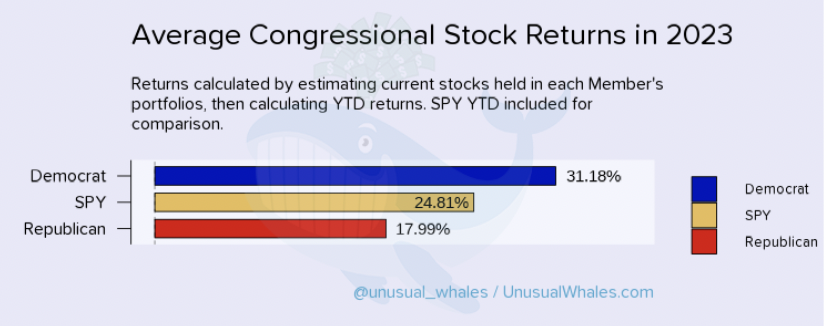

A recent report by a popular finance account on X, formerly Twitter, came out revealing that Congress Democrats dominated trading stocks as well as their year-to-date returns. According to the study, of 100 trading members, 33 percent beat SPY with their portfolios, with Democrats overcoming their Republican colleagues by a massive margin.

Members of Congress are required to disclose their finances through financial disclosure forms that are filed annually and every time they or their families make a trade. These forms, which are available through the Office of the Clerk of the House of Representatives and the Office of the Secretary of the Senate, are a key tool for promoting “ethical conduct” in Congress and an important effort to promote “integrity and transparency” in the legislative branch of the government.

The report of Unusual Whales analyzed data obtained from the disclosure forms published from 2020 to December 31, 2023. Congress typically files over ten thousand financial transactions each year and the year 2023 was no different with around 11,000 transactions filed. However, at the time of writing the report, the past year had the least transactions filed compared to previous pandemic years, mainly due to House Representatives filing fewer financial transactions. Politicians have up to 45 days to disclose transactions, though there are cases where transactions are filed years later with seemingly no penalty. This delay means that at the time of compiling this report, perhaps not all disclosures for 2023 have been published.

?BREAKING?

I have just released the full report on politicians trading in 2023.

Like every year since 2020, US politicians beat the market.

And many in Congress made unusually timed trades resulting in huge gains.

Here are the top performers of 2023. pic.twitter.com/ykf9VICsBw

— unusual_whales (@unusual_whales) January 2, 2024

House Republicans filed much less than their Democrat colleagues. Famous traders like Dan Crenshaw, Nancy Pelosi, Josh Gottheimer and others all beat the market this year. The report also indicated that Congress was trading options once again in 2023, more than the previous year, and the amounts are crazy at more than $150 million while Congress was in session including Pelosi’s technology giant Nvidia trades.

The fully independent and self-funded platform has been reporting on this for four years already, allowing them to accumulate a lot of data. This year, they focused on commenting on trading trends over the last couple of years. Since 2020, they have had three different classes come through those hallowed halls of Congress, with prominent stock traders coming and going.

Pelosi discloses 7-figure bet on NVIDIA over the Christmas holidays amid calls to ban lawmakers from trading stocks

Former House Speaker Nancy Pelosi and her venture capitalist husband Paul reportedly bet millions on Nvidia late last year amid immense scrutiny and backlash against congressional stock trading. Pelosi bought Nvidia call options on Nov. 22, which was reported to be her largest stock purchase in the last three years.

According to a disclosure form obtained by Unusual Whales and Congresstrading.com, Pelosi purchased 50 call options with a strike price of $120 and an expiration date of Dec. 20, 2024, with a potential capital gain of up to $5 million. “Pelosi bet millions on NVDA in November using call options. Using a deceptive tactic, she purposely disclosed this on the Friday before Christmas weekend to avoid media coverage,” Congresstrading.com revealed on X.

The Pelosis have re-entered the Nvidia game after selling their shares and call options in the artificial intelligence software company at a total loss of over $700,000 in 2022. Their ill-timed departures occurred around the same time that the CHIPS and Science Act was passed into law, which Pelosi publicly supported. This law majorly benefited domestic chipmakers like Nvidia. According to to the New York Post, since selling their 25,000 shares, Nvidia’s stock price has surged by almost 200 percent. This means that the value of the Pelosis’ original stake would have been worth over $12.2 million today. (Related: SEC charges former GOP lawmaker with ‘insider trading’ despite suspicious trades made by Nancy Pelosi’s husband.)

Still, the duo has certainly made up for it in other transactions. They have netted millions of dollars in profit from buying call options on other blue-chip stocks such as Salesforce, Roblox and Disney. They have also made some well-timed sales. The 83-year-old husband sold 30,000 shares of Google stock in December 2022, just one month before the tech giant was sued over alleged antitrust violations.

These transactions had lawmakers denounce insider trading. Sen. Josh Hawley of Missouri introduced the Preventing Elected Leaders from Owning Securities and Investments (PELOSI) Act in January 2023 as a measure to counter Congress trading. “While Wall Street and Big Tech work hand-in-hand with elected officials to enrich each other, hard-working Americans pay the price. The solution is clear: We must immediately and permanently ban all members of Congress from trading stocks,” he said.

For more stories similar to this, head over to BigGovernment.news.

Sources for this article include:

Submit a correction >>

Tagged Under:

big government, Big Tech, bombshell, business, cancel Democrats, Congress, corruption, criminals, deep state, insider trading, money, Nancy Pelosi, NVIDIA, portfolio, Republicans, rigged, spy, stock market, stock trading, stocks, tech giants, trade, treason, Wall Street

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 CONSPIRACY NEWS